During a loan verification process, the lenders check with the borrower’s credit score and credit report from Credit Information Bureaus to assess the creditworthiness of a borrower. Usually, a CIBIL score of 750 and above is considered to be fair, and the chances of getting a loan or credit card increases, and the borrower also gets attractive interest rates. In case of a low score, the lender might reject the personal loan application. On the other hand, if the credit score is high, the lender might look into further details to determine if the applicant is creditworthy.

What is a Good Score?

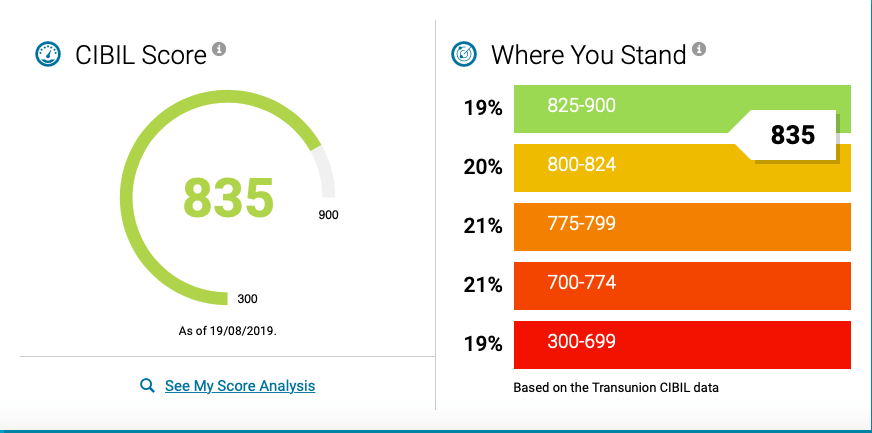

A good CIBIL score generally ranges between 300 and 900, wherein score closest to 900 is considered an excellent score to avail low-interest rates on loans. While many perks of a high credit score, such as a reasonable loan interest rate, are quite well-known. The higher your score, the better are your chances of getting a loan approved.

- High CIBIL Score

An individual’s credit score can range anywhere between 300 and 900; it usually depends on their credit behaviour. The closer your score is to 900, the higher your chances are of getting a credit card or easy approval of a loan application. Having a good score gives the borrower the leverage while applying for a loan, as the lenders are assured with a high score and want to lend to such borrowers.

Additionally, the amount the borrower wants, along with his/her income and credit score, is among the eligibility criteria set by most banks and lending institutions to determine the rate of interest charged. Hence, having a good score is crucial to get you a loan at a lower interest rate.

- Low CIBIL Score

When applying for a loan, the borrowers might find it hard to find lenders that offer low credit scores, but the interest rates that are provided by the lenders are also very high. However, the low CIBIL score category may vary from lender to lender. While most banks and lending institutions turn down borrowers with a low score, terming them as less creditworthy and having more credit risk, NBFCs and other financial institutions approve loans for such individuals but charge higher interest rates on loans.

Even for an individual who is not borrowing at the moment, needs to maintain and keep improving their CIBIL score. Individuals with higher scores also need to take measures to retain them. Hence, it is advisable to check your credit report at regular intervals, this will help you detect any error that can harm and lower your credit score.

Ways to Improve Your CIBIL Score

If your score is low, here are a few ways to improve your score:

- Make timely payment of your loan dues. It shows responsible credit behaviour and repayment ability.

- You need to have a right credit mix in your credit history of secured and unsecured credit. Having too much-unsecured credit like personal loans and credit cards makes lenders consider you as a risky borrower and may decrease your CIBIL score.

- Check your credit report for errors and fraudulent usage of data/information. If found any this needs to be reported and rectified promptly.

- Reduce your credit utilization. Try and limit your credit utilization to a maximum of 30% of your available credit limit. Spending more than 30% of the available credit shows excessive reliance on credit and reduces your score.

- Avoid applying for multiple loan applications and inquiries within a short period. This may increase the number of hard inquiries on your credit report and adversely affect your score.

- Ensure you pay off your debts instead of settling them. Though settling may reduce the debt burden, it shows an inability to repay your debts and adversely affect your CIBIL score.

Hey, I am Raj. I am the owner and content publisher at Financenize. I have completed my education till intermediate school and after that turn to a full-time blogger and content writer. I usually share the quality information for the readers in Financenize, which helps the small business, individuals and entrepreneurs and the information I share makes their task more manageable. I am expert in analyzing the current situation and deliver a profitable period to the extent. You can find me on various social media handles online.